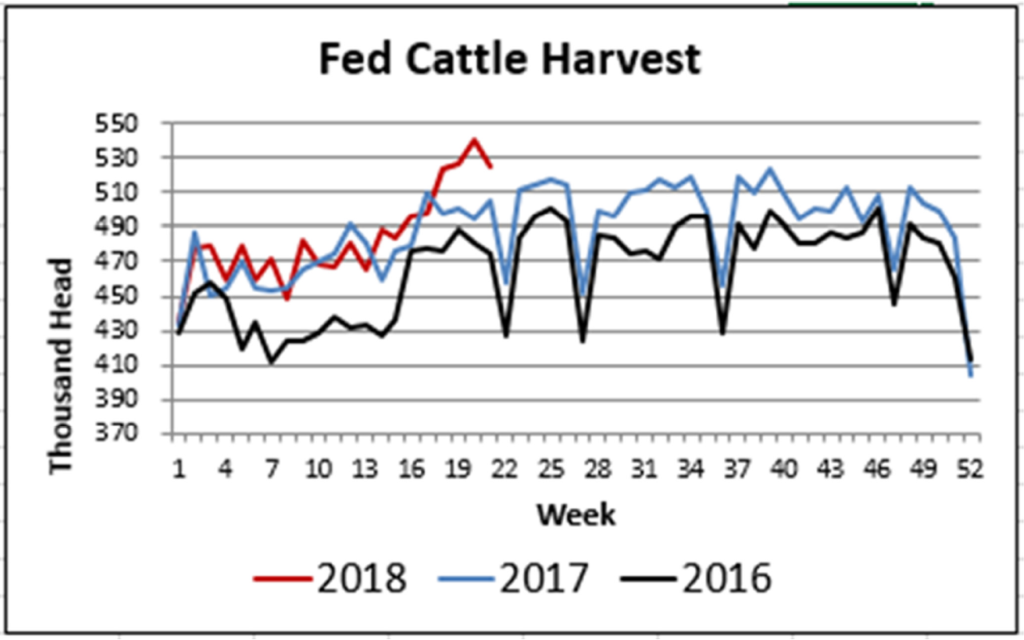

Beef production is heating up in a big way as the long-awaited fed cattle numbers have shaken loose. With the late April, early May bottleneck of tight supplies behind us, we now see the impressive ability of our nation’s packers to push production to the brink. Last week’s estimated 658,000-head U.S. federally inspected cattle harvest is the second largest this spring, surpassed only by the 667,000 head sum the week of May 14th. That number was the largest one-week total since October 2011, although some weeks in 2013 were in the ballpark with figures upwards of 650K.

The theme lately has been centered on increased fed cattle numbers available because of cow herd expansion, while drought in the south pushed cattle off of wheat pasture to feedlots ahead of schedule last fall. As well, packer profitability estimated by analysts near $270/head recently, has firms running big Saturday shifts at their plants to maximize throughput. Obviously that level of profit is an opportunity worth chasing. In 2011, prior to the major drought impact of 2012, it was not uncommon to see weekly head counts larger than 660K, with one week in June that year reaching as high as 690K head.

Packing plant capacities have changed since 2011 with closures of plants by Cargill, PM Beef and National Beef from 2013 to 2015. As such, the head counts we are now seeing represent plant utilization well ahead of capacity based on a 40-hour work week. Excluding the shortened Memorial Day week, we’ve seen 6 weeks now with more than 520,000 fed steers and heifers harvested, while CattleFax estimates industry capacity at 480,000 head in a 40-hour week (excluding cow plants). Packer profitability is working to keep feedlots current at this time – and the credit goes to beef demand, highlighted by increased export movement this year.

Market Update

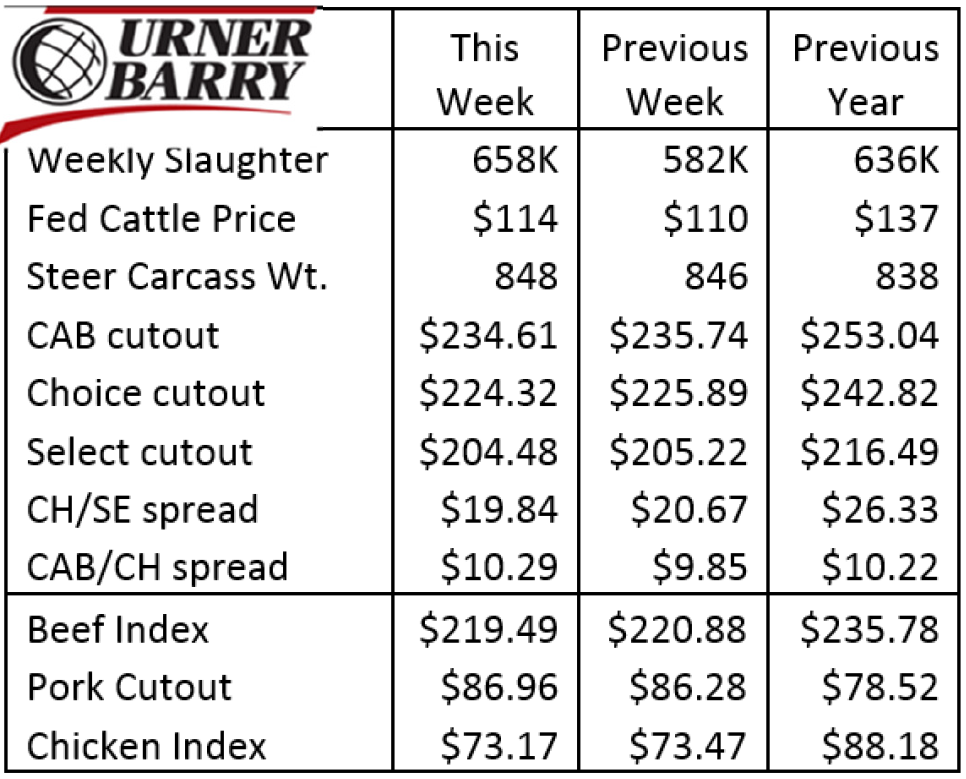

Last week’s 658,000 head federally inspected cattle harvest was yet another monster number, proving again that packer profitability coupled with available finished cattle supplies can drive volume quite high (see section above). Last week’s fed cattle market averaged above $114/cwt, a welcome jump for cattle feeders that demonstrated some packer willingness to give a little on price in order to secure the needed volume of cattle. Packer profitability estimates are in the range of $270-$280 per head, according to industry analysts.

On the end-product side of trade, we saw excellent demand up through and following Memorial Day with boxed beef prices holding up much better than some had feared based on larger volumes.

Even so, it appears we’ll now see that market soften some moving through June. If so, this will closely match the trends of a year ago when the CAB cutout (total carcass value) peaked at $255/cwt. during the week of June 12th and quickly retreated to $229/cwt. by the first week in July.

CAB subprimals showed a mixed bag of price direction with some give and take. Items from the round were firmly lower, however, continuing the slide that began in early spring. Overall, May/June is the typical timeframe when the round contributes least to the total CAB carcass cutout value. CAB ribeye rolls were 7 cents lower in last week’s spot market, their $8.98/lb. market average price a full 15% cheaper than a year ago (See section below for a discussion of the relative contributions of these two primals to the cutout).

Loin cuts were mixed last week but the higher tone saw 0x1 strip loins likely near their peak demand for grilling season. Expect those prices to decline in the near future as they have so predictably in the past 3 years. Tri-tips, however, remain on an increasing trajectory into the latter part of June, as are briskets that share similar summer demand. End users looking for steak alternatives at this time are looking at the teres major, which saw a seasonal price peak ahead of schedule this year, topping way back in April at $6.40/lb. and now down to $5.07/lb. The other famous chuck steak, the flat iron, is enjoying the opposite pattern today, pricing at $4.08/lb., 21% higher than a year ago. Two-piece boneless chucks are way down at $2.47/lb., a very cheap price point rarely seen anytime across the past four years. Grinds continue to follow the same cheaper price pattern we’ve reported for weeks, thus presenting a real sales opportunity.

Rounds, Ribs Vary Contribution to Beef Cutout

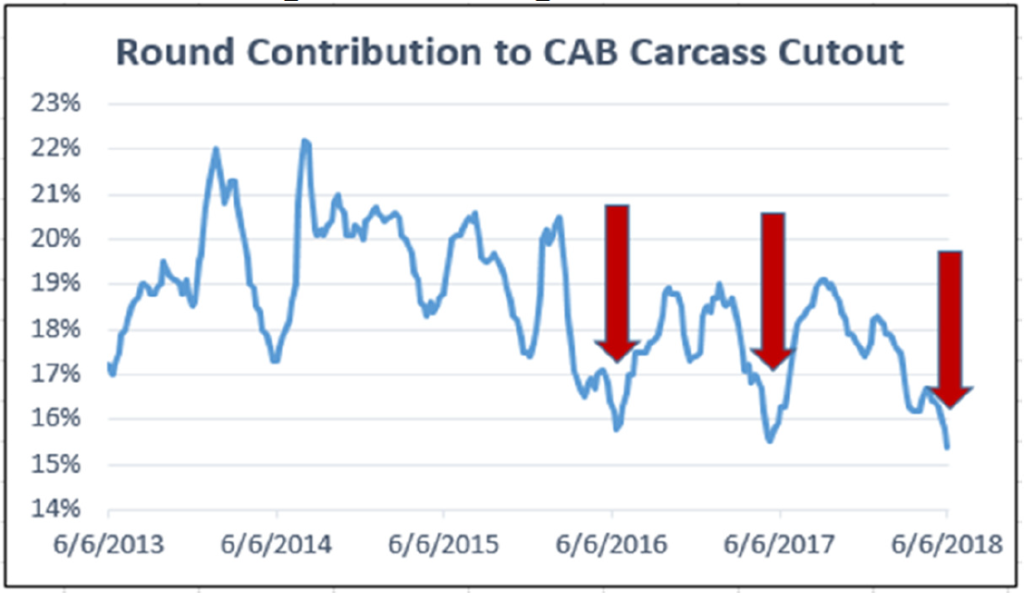

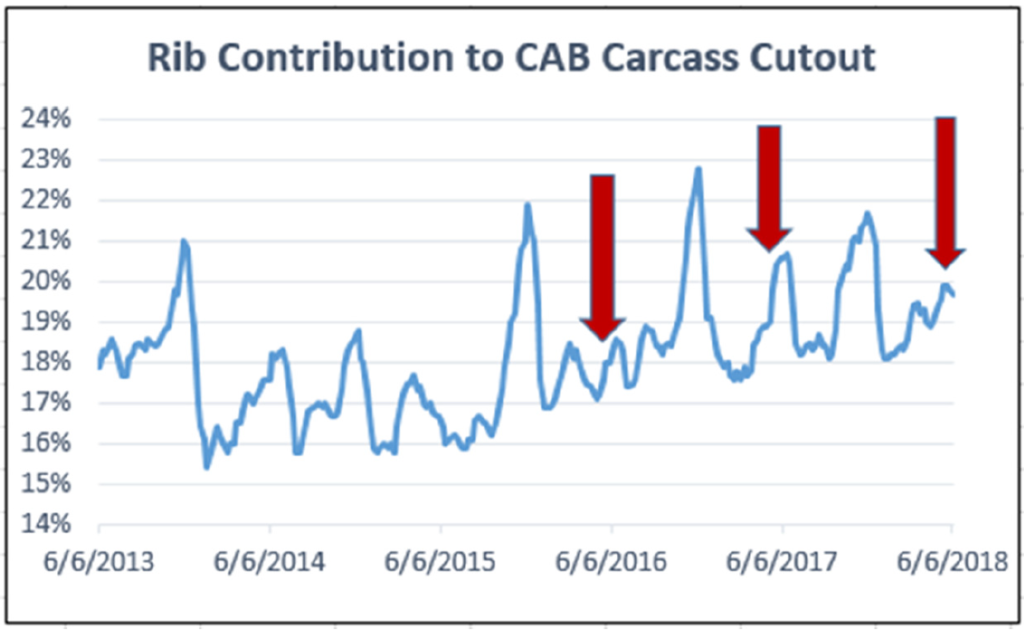

Disparity in the value of different carcass primals and subprimals is something we normally focus on during November/December when holiday ribs and tenderloins are the beef items of choice. However, in the past five years, the market has observed a growing separation between middle meats and end meats in May and June at the kickoff of grilling season. The two accompanying charts show perhaps the best illustrations with a focus on the rib and round primals.

Note how the contribution of the round, adjusted for weight, to the total CAB carcass cutout value has declined in early June to approximately 15.5% of the total cutout value, compared to 2013 through 2015. Granted, a 1- to 2-percentage-point move is not a lot, but the trend is still worth noting. It’s more significant when the increased value contribution of the rib to the CAB cutout is shown in comparison to the decreasing round value.

Clearly, when one primal contributes more, another must contribute less. The loin primal also spikes this time of the year and has increased from 30% prior to 2015 to 32-34% since then. Consumer demand in May and June is becoming more targeted to grilling middle meats, and there’s regional demand for briskets and tri-tips.